In terms of obtaining financing, understanding the search terms and you will standards is essential

Two extremely important phrases you might encounter within the credit processes are conditional acceptance and you may unconditional recognition. In this article, we are going to give an explanation for difference in conditional and unconditional approval and just how they’re able to impression your borrowing from the bank sense.

What is Conditional Recognition?

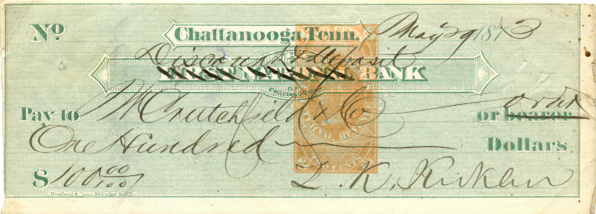

!role~Preview!mt~photo!fmt~JPEG Baseline)

Conditional approval is actually a first stage throughout the application for the loan procedure where in fact the financial critiques debt advice and you will papers. It offers you which have a sign of the new lender’s willingness so you can agree your loan, but it’s at the mercy of particular criteria being met. Such conditions constantly relate with taking extra files, appointment certain requirements, otherwise satisfying almost every other standards specified because of the financial.

When you look at the conditional approval phase, the financial institution assesses facts just like your credit rating, earnings, a job balance, and you may total financial position. They view if or not your fulfill the credit standards and find out the latest restrict amount borrowed they are ready to give you. You should note that conditional approval isnt a promise of final recognition, and there is a lot more procedures until the loan is completely recognized.

The necessity of Conditional Recognition.

Conditional recognition was an invaluable step in the mortgage software procedure. It allows you to definitely evaluate their credit strength to check out an excellent sensible budget for your residence research. In addition it displays to real estate professionals and you will sellers you is actually a significant visitors, since you have drawn the first actions with the protecting funding.

With conditional acceptance at hand, you can with certainty build an offer on the property and negotiate which have providers. They puts your for the a healthier condition versus almost every other possible buyers just who may not have obtained any style away from mortgage pre-recognition. However, just remember that , conditional recognition have a conclusion time, generally ranging from 31 in order to ninety days. In case the mortgage isn’t really finalised contained in this the period frame, you may have to re-apply having acceptance.

Swinging from Conditional to Unconditional Acceptance.

Once you have receive property and properly negotiated this new regards to purchase, the next step is to maneuver of conditional to unconditional recognition. It stage pertains to rewarding the remaining conditions lay by the bank, like taking property valuation records, finalized pick agreements, and any other requested data files.

Thus far, the financial institution conducts a thorough comparison of the home to be sure it fits its financing criteria. In the event the the requirements is actually found, your loan try supplied unconditional acceptance. As a result the lender is actually completely committed to offering the finance to suit your get, and you may go-ahead confidently on settlement process.

Unconditional recognition is a huge milestone as it suggests that your financing has become safer, susceptible to the fresh sufficient completion of the property get. It is important to be aware that even with unconditional acceptance, you need to still fulfill debt loans and prevent people significant alter into the economic circumstances in advance of settlement.

The bottom line is.

Regarding the lending fund globe, conditional approval is actually an initial action that allows that assess their borrowing from the bank capability to make advised choices. Unconditional recognition, concurrently, gets the promise the bank was committed to payday loans New Hartford Center funding their mortgage.

Understanding the difference between conditional and you may unconditional approval makes it possible to most readily useful navigate the loan software processes. It also helps your quote in the public auction so much more with full confidence.

As with any things finance brand new devil might be about facts. As always, we advice dealing with a mortgage broker who is not beholden so you’re able to any particular bank or lender.

Additionally it is a good idea to find a beneficial valuation over to the people property that is piqued the appeal. And you may reports thumb we can in reality organise an automatic property valuation for your requirements, at no cost. You simply need a message!

- Look for financing

- Apply for a different home loan

- Re-finance a preexisting loan

- Get a hold of a better rate of interest

Totally free automatic property valuation.

Only get into your details additionally the address of the home might including us to well worth. Following, we will planning your Automated Valuation Estimate and you will upload they on the email provided.