Upfront underwriting into the six time* after you implement online

Purchasing a property is quite exciting and you can very perplexing – all at the same time. Also it doesn’t matter when you find yourself an initial time family visitors or if perhaps it’s your next or 3rd date you take this new plunge into homeownership. That’s because the entire process of obtaining a mortgage, providing the support paperwork and you will waiting for a thumbs up from a mortgage providers enjoys generally already been one that’s very long and you will troublesome.

New part of the procedure that was most unclear to a lot of consumers – new stuff continues on behind brand new curtain, as we say – is the underwriting process. That’s because the typical mortgage applicant cannot understand otherwise know just what underwriter wants because they are family.

What’s mortgage underwriting?

Underwriting happens when a person in the loan people – brand new underwriter – analyzes a economic suggestions to evaluate in the event it suits the borrowed funds lender’s criteria and you will matches the needs of the fresh version of loan you’re trying to get. Especially, you are requested to provide:

- W-2s

- Taxation statements

- Present spend stubs

- Verification off a job

- Backup off regulators-given ID

- Permission to pull credit

Once examining these records, the newest underwriter establishes how risky its so you’re able to mortgage you the money you need. In reality, it’s an informed assume based on your credit history, your own possessions plus income out of how almost certainly youre so you’re able to generate home loan repayments promptly and ultimately repay the loan in complete.

Regrettably, of a lot financial companies manage the newest underwriting process once you have already located our home we would like to get, have put in a quote after which apply for home financing. By using too long available the required suggestions, or if the underwriter requires too-long for making a trip on the creditworthiness, you can miss out on your dream house.

Direction Home loan do things a bit in different ways. I underwrite every loan early in the borrowed funds process. This gives you a critical advantage in a crowded markets as suppliers will undertake a bid which is currently underwritten and you can pre-passed by a mortgage lender. Its more of a yes situation. Very early underwriting can also help end people past-minute race. Our very own reverse means is special – i assess the financing and you will make an effort to have it put-out away from underwriting contained in this 6 days* – letting you avoid market full of exhausting and sluggish lenders.

But what, exactly, is the underwriter doing once they pick whether or not to agree your for a loan? Why don’t we read.

The 3 C’s

Following significantly more than files (and perhaps a few other people) try attained, an underwriter will get right down to providers. It have a look at borrowing and you will commission history, earnings and you will property readily available for an advance payment and you may categorize its conclusions once the Three C’s: Ability, Borrowing and Security.

The underwriter will at the capacity to pay-off a loan by comparing the monthly revenues facing your overall monthly repeating bills. That will result in a numerical figure called the loans-to-earnings (DTI) ratio. They will including take into account property such as your financial comments, 401(k) and you will IRA profile.

Here, the latest underwriter is wanting to make sure you are able to afford to pay for coming mortgage payments on top of latest obligations. Simultaneously, they want to verify that you really have adequate liquids dollars readily available and then make a down-payment. Otherwise, you are required to spend month-to-month personal home loan insurance coverage (PMI) at the top of concept and notice.

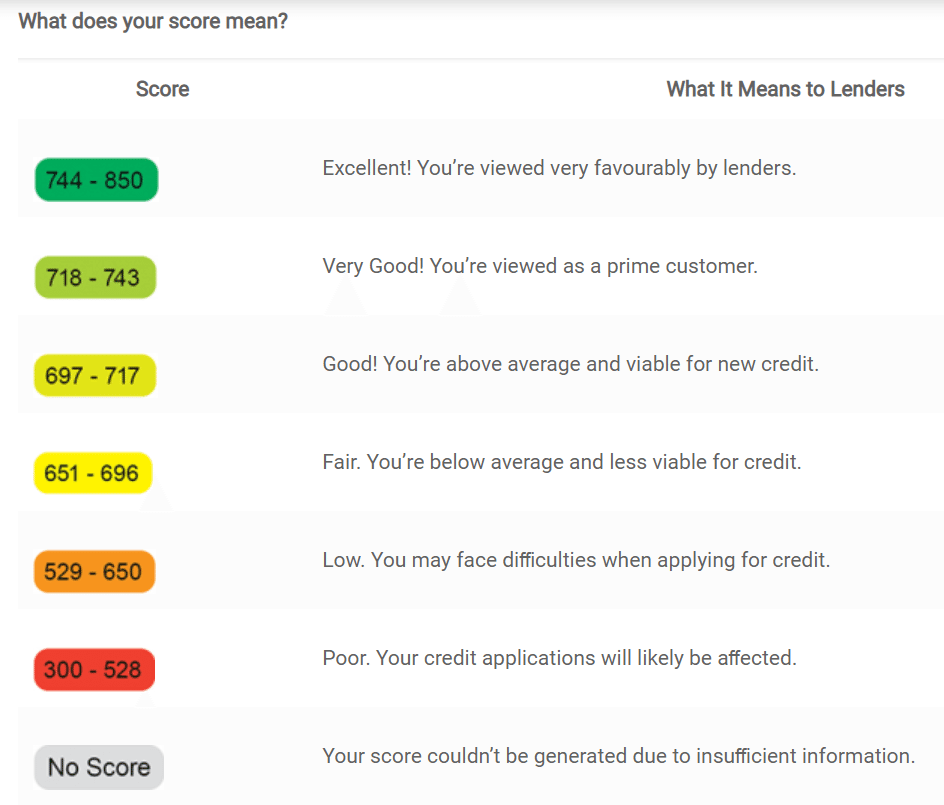

Underwriters examine a combined credit history on three federal credit reporting agencies – Equifax, Experian and you may Trans-Connection – to see just how you have handled paying obligations previously. During this stage, they’re going to get a feel based on how much credit you take toward, just what terminology was and in the event the early in the day credit score brings up people warning flag regarding how you can easily do paying back the mortgage.

This information will assist the latest underwriter decide which form of financing is the best for your unique state, exacltly what the rate of interest will likely be or you was refuted, as to why. For those who haven’t discovered by now, which have a credit rating has become the most important basis in getting a beneficial financial words.

Right here, your own financial is looking so you can hedge the wagers and when Southwood Acres loans your standard to your mortgage. To take action, it buy property appraisal to ensure the new house’s well worth, not only the amount of the mortgage, to see a loan-to-really worth proportion (LTV).

If you’re looking to buy a separate home, brand new LTV ratio was computed because of the breaking up the total amount by the either the purchase price and/or appraised worthy of, whatever is leaner. LTVs come towards play whenever you are planning on refinancing an excellent financial or you want to borrow against new collateral you may be building of your home. Note that only a few LTVs are identical: different varieties of mortgage loans have additional LTV requirements.

Query relatives and buddies just how long it grabbed so they can manage to get thier underwriting approval. Specific loan providers may take anywhere from three days to each week to locate back to you. Sometimes even more.

Within Way, our mission will be to possess underwriting complete upfront in as little as the half dozen days* off getting the application. Provided, it timeline will be impacted by several things: how quickly you turn in the documentation, vacations in addition to time you complete your application.

When you are a possible homebuyer having a concern regarding the underwriting approvals and other areas of the mortgage process, reach out to our local financing officers to go over your options. Otherwise, when you find yourself willing to start off today, you can apply on the web!

*While it’s Movement Mortgage’s objective to incorporate underwriting abilities within this half a dozen times off researching a credit card applicatoin, process fund when you look at the 7 days, and you may close-in one day, extenuating points could potentially cause delays outside it window.

Mitch Mitchell try a self-employed contributor in order to Movement’s sales service. The guy and writes regarding technical, on the internet shelter, this new digital studies society, traveling, and living with animals. He’d wanna real time someplace warm.