Combine obligations repayments into the that much easier payment

During the Domestic Home Capital, we could help you make a structured payment plan that will put you on track to repay all your unsecured outstanding debts and help you learn to generate voice economic possibilities that will help you stay care-free. Using this type of package set up you could potentially:

- Eradicate Costs

- Pay off the debt much faster

- Reduce their Mortgage Insurance coverage

- Lower your overall interest levels

- Prevent range phone calls

- One-on-One private classes and you can service

Being qualified getting a debt consolidation Re-finance

So you can qualify for a debt consolidation loan which can enable you to pay your other expense, you’ll want sufficient collateral of your house is qualified to borrow you to higher sum. Some financing programs reduce number you can use doing 85% of home’s really worth (conventional and you will FHA), and others payday loans Union Grove allows doing 95% or higher (VA). The present day property value the house or property might possibly be dependent on an assessment held by a licensed, 3rd party appraiser. This will be determined and explained to you because of the an enthusiastic RHF loan manager.

Therefore, simply how much improvement is a profit-aside re-finance generate?

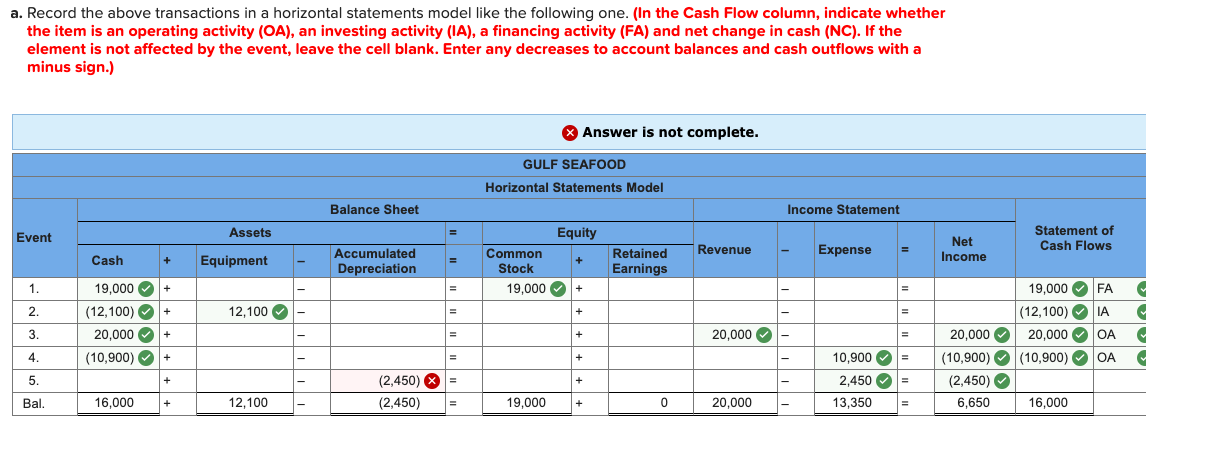

Less than try an example of how much cash you can probably rescue inside monthly obligations when you move their credit debt with the home financing refinancing:

Deal with the root cause of one’s financial obligation

Refinancing the financial to cover credit debt was an easy develop, so be sure you is bringing the economically compliment step necessary to stop obligations progressing!

Do you know the interest rates on the most recent loans?

Rates toward financial obligation are different widely. There have been two people deciding the interest prices in your debt: your credit rating, and you may whether the obligations is actually covered or unsecured. Funds which might be attached to security (secured) are apt to have far lower rates than money which aren’t.

What type of mortgage should you re-finance to your?

Mortgage enterprises bring numerous financial points. Here’s a simple conclusion of a few ones, centered on certain small comparison activities:

30 Season, 20 Seasons, 15 12 months Repaired Rates Financial

More often than not, 15-12 months mortgages can get interest levels which can be less than 20 seasons and you may 29 12 months mortgage loans, since the faster payment period reduces the chance for the bank. Although not, since the time of financing is compacted, the general fee will usually be substantially high. Generally speaking, 15-seasons financing is to only be taken out if you possibly could pay for the greater commission while the more cash becoming fastened is not required for something else.

Varying Speed Rather than Repaired Price Mortgages

Varying rates mortgages are also labeled as a beneficial 5/step one Case, 7/step one Arm or a ten/step one Case. The number to the left reveals the length of time the pace is repaired to own, plus the number off to the right suggests the newest volume the rate are able to increase or off pursuing the very first fixed speed period. Instance, a good 5/step 1 Sleeve mode the interest rate stays repaired for 5 many years, after which can to switch immediately following every a dozen (12) months pursuing the first repaired rate period. Changeable Speed Mortgages constantly hold a lesser initial interest and you can percentage than simply a fixed-speed home loan, but make sure you are regarding the financial position to anticipate any possible develops when you look at the payment in the future if the speed in your mortgage rises. Generally speaking, a supply could well be ideal for people that thinking about promoting their property before the repaired period of the financing end, or anticipate which have extra dominant to invest down the mortgage before plan.

Realization

Thus, you have experienced all of the computations a lot more than. You really can afford a cash out refinance loan to pay off your debt and keep maintaining some extra change depending on the initially scenario. Your credit score is good adequate to obtain a good desire rates.