House Collateral Finance having Next Home buyers: Things to Discover

Vidhi S. try a bona-fide property fan. Their particular blogs treks readers action-by-action from the selling or buying techniques, of pre-approval in order to closing. Within her free time, you’ll find their own immersed for the a great novel.

Prayas B. are an information-oriented content editor devoted to Western real estate. Inside the leisure time, he have hitting the mountain to have a game of activities or watching motorsports.

?? Editor’s Mention: Agent Connections, agencies, and you will MLS’ have started implementing change pertaining to the NAR’s $418 mil settlement. When you are family-providers will most likely conserve thousands for the commission, compliance and litigation threats has rather enhanced getting manufacturers regarding country. Find out how NAR’s settlement affects home buyers.

The average mortgage holder now has a record $299K inside equity, right up out-of $274K in the 2022. Property owners was needless to say offered a home because the most readily useful investment in the the modern industry. But that it go up presents an important question: Can you use a home security financing to acquire a new household?

The answer is straightforward; yes, you could. But many struggle with liquidity questions even yet in a bull market, making it tough to pick property downright. One of the better an easy way to safe more finance such circumstances is to find a property equity loan toward a preexisting property.

You might think a property security personal line of credit (HELOC), but one another keeps its gurus and drawbacks. Once you want to borrow against your house collateral, you’ll need a loan provider that offers appropriate terms.

What is a home Equity Mortgage?

A property collateral mortgage is another home loan in which you borrow money up against your property’s security. Your family will act as security toward mortgage. You’ll receive a lump sum of cash you need to pay back more a predetermined title.

Since you pay the borrowed funds costs, your control of the very first assets will increase. The borrowed funds is founded on the difference between the house’s most recent market price as well as the an excellent financial equilibrium to determine current domestic equity.

Loan providers assess the loan matter because of the assessing the modern ount you however owe on your financial. Your property collateral is the recurring number, which you may borrow secured on with a house guarantee financing.

Fixed rates was a familiar function away from a house guarantee capital. In contrast, selection instance house security personal lines of credit having investment property provides changeable rates.

Are you Eligible for a property Collateral Loan?

Just before we move on to the methods for you to get yet another household when you find yourself running a house, let’s just take a simple go through the qualifications standards.

- Features no less than 20% of your house equity.

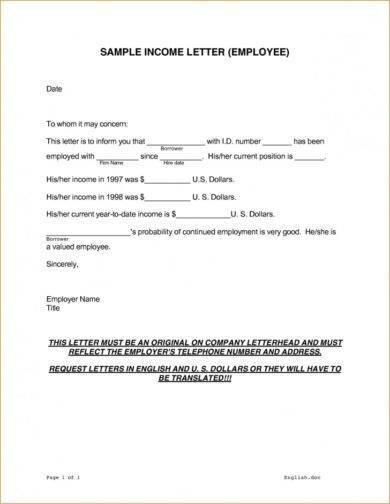

- Evidence of earning profits continuously for around couple of years, eg tax statements and Function W-dos.

- The very least credit score out-of 620 credit rating.

- Debt-to-income proportion regarding limitation 43%.

Estimate Your property Guarantee: You might imagine your house guarantee which have Houzeo’s extremely right family well worth estimator. This really is totally free an internet-based, providing you with a projected real estate market really worth

Sure, you can get a special home with your existing house’s security. There have been two kind of loans that permit you get possessions using domestic collateral:

1. Family Equity Funds (HEL)

Property collateral loan also provides a lump sum payment of cash built on your collateral in the present household. Let`s say the value of your home is $600,000, along with home financing of $three hundred,000. This means you may have $3 hundred,000 for the security.

Now, suppose the lender allows you to use as much as 90% of one’s offered domestic security to order a different sort of family personal loans online New York. This means maximum cash you can use was $600,000 ? 0.ninety = $540,000.