Utilize your residence’s collateral to own economic freedom

Needs a good HELOC, when deciding to take cash out out-of my personal residence’s equity. Can i pay money for an assessment, just after my bank did an automated appraisal that displayed a diminished worthy of than my house may be worth?

I got myself my personal domestic cuatro weeks back and also the in home appraisal cherished my house on $220k. My personal tax assessment was available in from the $209k. Cost in my own area provides risen quite since i have encountered the appraisal. I removed a beneficial HELOC nevertheless the bank’s robo-appraisal simply came back within $190k. Could it be worth every penny to expend $350 for the next home based assessment, hoping the worth of the home might be large? The lending company would not accept the only currently complete. My home loan equilibrium try $175k and that i need financing to possess $25k.

There are several separate things within your own question: the sort of appraisal a loan provider need, the new LTV you should meet the requirements, and you may whether or not you really need to purchase an assessment thus far.

Type of Appraisals

Because you most likely learn, the brand new taxman’s valuation in your home has an effect on how much cash you’ve got to spend inside the possessions taxation. When a tax assessor brings a specific buck value on home, simple fact is that government’s viewpoint of your own house’s fair-market price. But not, the actual money investigations isnt employed by people home loan company, nor can you use it to choose sales price to possess your property.

Mortgage lenders more often than not some kind of an appraisal having an excellent home loan. There are different types of appraisals. not, for the majority money, particularly an enthusiastic FHA Streamline refi, no assessment may be required. Dependent on your house and mortgage, a lender will generally need among the many pursuing the around three items off appraisals:

- An entire, official appraisal: You only pay to possess a licensed appraiser in the future more and find out the house. Brand new appraiser submits an excellent valuation, according to a professional studies from exactly how your residence compares to property near you off a similar size and reputation, considering what they sold getting recently.

- A push-by the assessment: A push-of the appraisal is additionally by the an authorized appraiser. Due to the fact title suggests, brand new appraiser views the home on the additional, to consider the standard standing. A push-of the isn’t as detailed because the a full assessment. Additionally, it concerns an evaluation toward value of comparable homes near you.

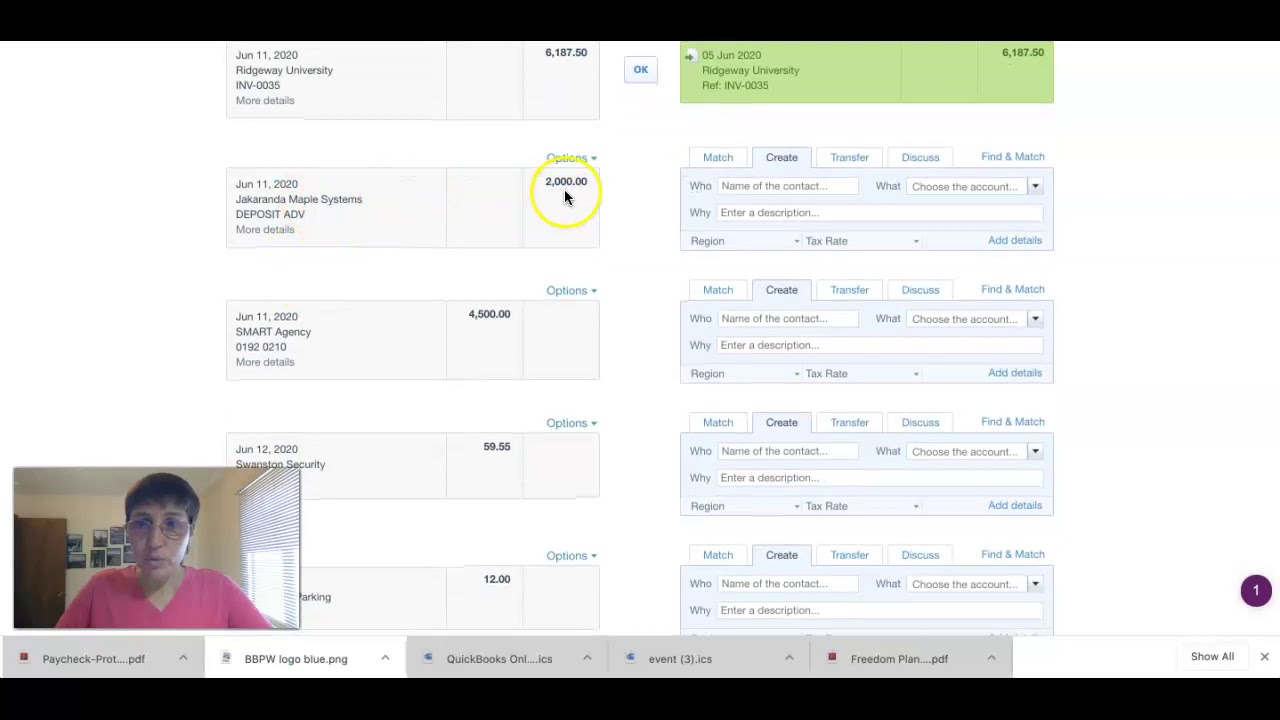

- An automatic appraisal: An automatic assessment, and termed as a keen AVM (automatic valuation model) is not done by an authorized appraiser. Alternatively, it is produced by a mathematical model using a databases that have suggestions such as the sales price of comparable land and you can property income tax assessments. It will not involve individuals watching your property after all.

In the event your appraisal will come in underneath the worthy of you believe your own home is worth, very first have a look at and discover that first details about the brand new appraisal is correct (square footage, amount of bedrooms, etcetera.). You could interest the financial institution to obtain the appraisal analyzed or reconsidered.

Appraised Worth and money-aside

You’ve got several main options for providing cash out of possessions, a special, cash-out first-mortgage from the increased balance otherwise a moment home loan, sometimes a home Security Loan otherwise a house Guarantee Distinct Borrowing (HELOC). The brand new appraised property value your house is a key component when you look at the determining how much a lender try ready to lend you. LTV limitations are very different getting a refinance mortgage, a buy mortgage, otherwise a beneficial HELOC. As an instance, FHA pick money will let you obtain around 96.5% of your residence’s well worth. However, regulations for the money-out refinancing are very different. There are a problem getting a special cash-out first mortgage, due to LTV limitations.

- FHA dollars-out: An FHA dollars-away refinance is restricted in order to a keen 85% LTV getting a predetermined-price home loan.

- Old-fashioned loan bucks-out: You’re restricted to 85% LTV to possess a fannie mae recognized cash-aside antique, fixed-price financing on a single family relations home which is your primary quarters. Fannie’s allows a max 70% LTV to own a variable-price home loan (ARM). LTV limitations try straight down getting 2nd house and you may resource functions

Small idea

if you are looking to possess a money-away refinance loan, otherwise want to re-finance for another reasoning, score a no cost home loan estimate away from a member of the brand new bills financial community.

CLTV and you can HELOC

Your capability so you’re able to refinance is additionally impacted by brand new joint loan-to-worthy of (CLTV). New CLTV is dependent on the portion of your house’s really worth additionally the full amount you borrowed of one’s first mortgage together with any other using funding, 2nd or 3rd mortgages.

Such as for instance, a home worth $200,000 which have an initial loan of $140,000 and you will good HELOC of $20,000, could have an excellent CLTV from 80% ($160,000 of mortgage loans from the $200,000 household well worth).

Any lender given the job getting a HELOC doesn’t just go through the sized the latest HELOC financing you prefer, but on CLTV. An over-all principle is that HELOCs could be capped on an excellent 80-85% CLTV, with respect to the bank as well as your compensating economic affairs regarding personal debt-to-earnings proportion and possessions.

Cashing-Away

On the certain case, your existing home loan equilibrium was $175,000. Five weeks back your residence is appreciated, into the a proper appraisal, at the $220,000. If it is well worth that now, and you are limited to 80% CLTV, the most you could potentially borrow will be $176,000, so that you won’t meet the requirements. Whether your financial desired your a keen LTV of 85%, then chances are you would be able to borrow $187,000. In the event that costs for the mortgage is actually decided inside the, you would more than likely internet below $ten,000. Of several loan providers wouldn’t give a good HELOC to own such as for example lower amounts.

The fact you purchased the home just five month’s in the past could be a problem. Considering Fannie Mae’s rules on dollars-out refinances, “In case the possessions was ordered inside earlier in the day half a year, the brand new debtor is actually ineligible for an earnings-aside transaction unless of course the mortgage suits new delayed resource exception” readily available for folks who paid back dollars with the domestic then wanted when planning on taking cash out.

Usually do https://paydayloancolorado.net/shaw-heights/ not Purchase an assessment

Purchasing an assessment, on this occasion, does not apparently make experience. The common complete appraisal can cost you from the $eight hundred, even though costs will vary according to a portion of the country in which you may be located plus the difficulty of appraisal. Such as, if you live on an unusual possessions or an incredibly pricey assets, you are going to spend a high speed.

Before you purchase an assessment, I will suggest that you speak with one possible financial and find from the limitation LTV for your possessions. It will see odd your “robo appraisal” (an AVM) your bank made use of returned with so lower worthy of than simply their official assessment of not even half a year before.

Recall prior to paying for one appraisal bought because of the a bank that the assessment have a tendency to belong to the lender, to not ever you, even though you paid for it. For individuals who switch to yet another financial, since you get a hold of a far greater price, for-instance, be ready to pay money for a new appraisal.